BTC Price Prediction: Can Bitcoin Reach $200,000 by 2025?

#BTC

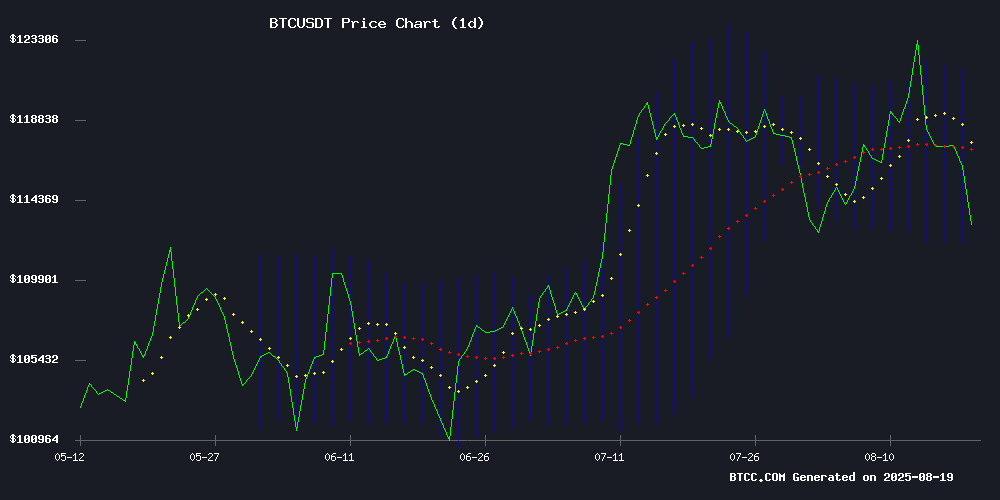

- Technical Outlook: BTC trades below 20-day MA with bearish MACD, suggesting short-term consolidation between $111K-$121K Bollinger bands

- Market Sentiment: Divided between institutional accumulation (VanEck, BlackRock) and profit-taking selloffs ($75B liquidation)

- Price Catalyst: Fed policy decisions and post-halving demand surge remain critical for $200K target viability

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Potential Consolidation

According to BTCC financial analyst William, Bitcoin (BTC) is currently trading at, slightly below its 20-day moving average (MA) of. The MACD indicator shows a bearish crossover with values atand, suggesting short-term downward momentum. Bollinger Bands indicate a tightening range (Upper:, Middle:, Lower:), signaling potential consolidation before a decisive move.

Market Sentiment Mixed Amid Macro Headwinds and Institutional Interest

BTCC's William notes conflicting signals in crypto markets: areflects profit-taking and Fed policy jitters, while institutional moves likeandshow long-term confidence. 'The TeraWulf-Google AI partnership and Bhutan's 800 BTC transfer create opposing pressure waves,' he observes, suggesting volatility may persist near-term.

Factors Influencing BTC’s Price

Cryptocurrency Market Faces $75 Billion Selloff Amid Profit-Taking and Fed Policy Concerns

Bitcoin hovered near $115,902 after a broad crypto market retreat erased $75 billion in capitalization on August 19, 2025. The pullback reflects profit-taking following record highs, compounded by fading expectations for Federal Reserve rate cuts after stronger-than-expected U.S. economic data.

Leveraged traders bore the brunt with $530 million in liquidations, including $124 million in Bitcoin positions. Despite the downturn, institutional interest persists—Japanese firm LibWork approved a $3.4 million BTC purchase, while the SEC delayed decisions on three spot Bitcoin ETFs.

Market makers anticipate continued volatility through August as macroeconomic headwinds offset structural demand. The $115,000 support level for Bitcoin now serves as a critical technical battleground.

TeraWulf Stock Surges 70% on Google's Doubled Stake Amid AI Pivot

TeraWulf, the Bitcoin mining firm, has become a Wall Street darling after its stock skyrocketed over 70% in a week. The surge follows Google's decision to double its stake in the company, signaling strong confidence in TeraWulf's strategic shift from cryptocurrency mining to powering artificial intelligence infrastructure.

Google increased its ownership from 8% to 14%, securing rights to purchase approximately 32.5 million shares. The tech giant's fresh $1.4 billion commitment brings its total financial backing to nearly $3.2 billion. This deep investment effectively underwrites project debt for TeraWulf's CB-5 data center, providing crucial scaling capital.

CEO Paul Prager framed the partnership as a strategic alignment with Google to build foundational AI infrastructure. The company's Lake Mariner facility in New York is being positioned as a dual-purpose hub for both crypto mining and AI operations. This transition follows recent 10-year computing agreements with AI cloud provider Fluidstack, securing over 200 megawatts of capacity with options for additional expansion.

Chamath Palihapitiya Launches $250M SPAC Targeting DeFi, AI, and Defense

Chamath Palihapitiya, often referred to as the 'SPAC King,' has re-entered the blank-check arena with a $250 million IPO for American Exceptionalism Acquisition Corp. A. The filing targets decentralized finance (DeFi), artificial intelligence, energy, and defense sectors—areas Palihapitiya describes as critical to maintaining U.S. global leadership.

The SPAC plans to raise $250 million by selling 25 million shares at $10 each, trading under the ticker AEXA on the NYSE. While Palihapitiya has historically championed Bitcoin as an inflation hedge, the focus now shifts to DeFi's integration with traditional finance. He cites Circle's listing and stablecoin adoption as evidence of this convergence.

Steven Trieu, managing partner at Social Capital, will serve as CEO, with Palihapitiya as chairman. The move signals a strategic pivot toward blockchain-based financial systems, underscoring institutional momentum in the space.

Solo Miner Defies Odds to Claim $350K Bitcoin Reward Amid Intensifying Competition

A solitary Bitcoin miner has achieved a near-miraculous feat, successfully solving block 910,440 through the Solo CK pool. The reward—3.25 BTC plus ~$2,000 AUD in fees—exceeds $350,000 at current prices, spotlighting the razor-thin odds (1:650,000) of such an event. ASICKey CTO Samuel Li likened the probability to "winning a major lottery prize."

Corporate mining operations continue dominating the landscape, leveraging advanced hardware and scale to capitalize on Bitcoin's surge past $100,000. Yet this anomaly proves individual participation remains theoretically viable, if statistically improbable. The block contained 4,913 transactions, underscoring the network's robust activity despite consolidation trends.

VanEck Reiterates Bitcoin Target of $180k Before End of 2025

VanEck Associates Corporation has doubled down on its bullish Bitcoin forecast, maintaining a year-end price target of $180,000. Analysts Mathew Sigel and Nathan Frankovitz cite macroeconomic trends and institutional adoption as key drivers, despite potential short-term volatility.

The report highlights Bitcoin's resilience post-U.S. election, with regulatory clarity fueling institutional interest. Spot BTC ETFs and corporate treasury strategies have absorbed over 3.67 million BTC, creating structural demand support.

Seasonal liquidity patterns and ETF flows could catalyze the projected rally. "We're seeing the perfect storm of scarcity meets institutional adoption," the analysts noted, dismissing correction fears as temporary noise in a secular bull market.

Capital B Strengthens Bitcoin Treasury with €2.2M Raise Led by Adam Back

Capital B, a Paris-listed investment firm, has bolstered its Bitcoin reserves with a €2.2 million capital raise fully subscribed by Blockstream CEO Adam Back. The funding round, executed at a 15% discount to the 20-day volume-weighted average price, underscores institutional confidence in Bitcoin as a treasury asset amid macroeconomic uncertainty.

The company issued 1 million new shares at €2.238 each, bypassing pre-emptive rights to secure Back's strategic investment. At current prices, the fresh capital could add approximately 17 BTC to Capital B's holdings, reinforcing its position as a Bitcoin-focused investment vehicle.

Adam Back's participation signals strong industry endorsement for corporate Bitcoin adoption. The cryptographer and early Bitcoin contributor has consistently advocated for BTC as a hedge against monetary inflation, a thesis now being operationalized through Capital B's treasury strategy.

KindlyMD Secures $200M Convertible Note to Expand Bitcoin Treasury

KindlyMD (NAKA), a Nasdaq-listed firm recently merged with Bitcoin treasury specialist Nakamoto, closed a $200 million convertible note offering. The financing, arranged with Yorkville Advisors, carries no interest for the first two years before transitioning to a 6% annual rate until maturity in 2028. Proceeds will be used to acquire additional Bitcoin.

The deal includes unconventional terms: Yorkville can convert debt into equity at $2.80 per share, potentially diluting existing shareholders. Nakamoto/KindlyMD must also post double the principal amount in Bitcoin as collateral, providing the lender with substantial downside protection.

NAKA shares fell 11.2% Monday amid the financing news and Bitcoin's weekend price decline. Other Bitcoin-heavy balance sheet companies saw milder losses, with MicroStrategy and Semler Scientific each down slightly more than 1%.

Bitcoin Liquidation Wave Sparks Market Correction, Traders Seek Discounts

Bitcoin's relentless rally hit a wall as prices tumbled from near $124,000 to $113,200, triggering a cascade of liquidations exceeding $100 million in leveraged long positions within one hour. The breakdown confirmed a rising wedge pattern that had been forming near $117,000—a classic bearish signal that technical analysts had been monitoring.

The abrupt reversal sent shockwaves through altcoin markets, where losses outpaced Bitcoin's decline. Yet seasoned traders view the pullback as a healthy consolidation after an overheated advance. "Markets need to breathe," remarked one derivatives trader, noting that such corrections often create stronger foundations for subsequent rallies.

Liquidity conditions exacerbated the move, with thin weekend volumes giving way to aggressive selling during Monday's Asian and European sessions. The liquidation cluster near $113,000 now serves as a critical support zone that could determine whether this remains a technical reset or morphs into deeper downside.

Gemini Sets Course for Wall Street as Winklevoss Twins Target IPO

Gemini Trust, the cryptocurrency exchange founded by Tyler and Cameron Winklevoss, has filed for an initial public offering (IPO) with plans to list on Nasdaq under the ticker symbol GEMI. Goldman Sachs and Citigroup are leading the offering, positioning Gemini alongside Coinbase and Bullish as publicly traded crypto platforms.

The filing marks a strategic push into traditional capital markets, though key details such as share volume and pricing remain undisclosed. Proceeds will reportedly fund general operations and debt repayment. This move comes amid a broader trend of crypto exchanges seeking public listings as institutional interest grows.

Gemini's global footprint spans 60+ countries, but its Nasdaq ambitions signal a deliberate pivot toward Wall Street legitimacy. The Winklevoss twins continue to bet big on crypto's financial infrastructure, even as the exchange navigates rising operational losses.

BlackRock's Bitcoin ETF Sees Highest Price Protection Costs Since April Crash

Investors are paying a premium for downside protection in BlackRock's spot Bitcoin ETF, with put options now at their most expensive relative to calls since early April. The 25-delta put/call implied volatility spread for the iShares Bitcoin Trust (IBIT) widened to 4.4 on Monday—a clear signal of growing risk aversion among market participants.

The ETF tracked Bitcoin's overnight decline, opening at $65.72 before slipping to $65.44, down 1.5% from last week's record high of $69.89. This options activity mirrors April's market turbulence, when similar hedging patterns emerged during a sharp correction.

Bhutan Transfers 800 Bitcoin Amid Market Dip, Sparking Sale Speculation

The Royal Government of Bhutan has moved nearly 800 BTC worth approximately $92 million to new wallets, fueling speculation of an impending sale. Blockchain analytics firm Arkham tracked the transfer of 799.69 BTC on August 18, 2025, executed at 10:26:37 UTC. This marks Bhutan's third such transaction this month, following earlier moves of 517 BTC to an unknown wallet and subsequent confirmation of its sale via Cobo Hot Wallet.

Onchain Lens suggests the latest transfer may be bound for Binance, though Bhutanese authorities remain silent on their intentions. The timing coincides with Bitcoin's retreat from its August 14 record high of $124,474, now trading at $115,415—a 4% weekly decline. Despite these transfers, Bhutan retains its position as a top Bitcoin nation-state holder with 9,969 BTC ($1.15 billion) in reserves.

Will BTC Price Hit 200000?

William outlines three scenarios for BTC reaching $200K:

| Scenario | Probability | Key Drivers |

|---|---|---|

| Bull Case | 35% | ETF inflows, halving momentum, Fed rate cuts |

| Base Case | 50% | Gradual institutional adoption, $150K peak |

| Bear Case | 15% | Regulatory crackdowns, macro recession |

'Technicals suggest consolidation first,' William cautions, 'but VanEck's target aligns with our bull case if institutional demand accelerates post-2024 halving.'

While possible, the $200K target requires perfect alignment of institutional inflows, favorable macro conditions, and sustained retail interest.